IFTA compliance is one of the additional accounting responsibilities unique to trucking companies. Fortunately, it doesn’t have to take up too much time or energy if you plan ahead. The ever-expanding capabilities of modern software have made many aspects of business ownership significantly easier. You must be strategic about which tools you invest in to avoid wasting resources, but it’s worth utilizing in many areas. One of the primary problems with managing your small business accounting is the sheer amount of time and energy it takes. Running a trucking company alone is enough work to keep you busy, and trying to do both is a lot to handle at once.

What is transportation accounting?

With integrated systems, you can also gain access to real-time data that can help you make better business decisions. For example, you can track fuel usage, monitor vehicle maintenance, and analyze driver behavior to identify areas for improvement. Setting clear expectations for deadlines and output is also important when working with a trucking accountant. Make sure that you both understand what is expected in terms of deliverables and timelines so that you can work together effectively to achieve your financial goals.

How Does Trucking Accounting Software Work?

Integrating your trucking accounting software with dispatch and fleet management systems can provide significant benefits for your business. By automating the invoicing and billing process, you https://www.simple-accounting.org/nonprofit-service-organizations-use-them-but/ can save valuable time and reduce the risk of errors. Additionally, integrating these systems can help you better manage your fleet, monitor driver performance, and improve overall efficiency.

Can I use Quickbooks for a trucking company?

Some software even offers free filing, which means they’ll generate tax reports for you based on your year’s finances and submit them. This can save your company time and stress and ensure your taxes are done accurately to save you money. Owners of trucking companies have a lot to consider when doing their accounting. TruckingOffice is a TMS service that helps owners and operators track their miles, manage their expenses, pay attention to their profits and stay on top of fleet maintenance.

It helps manage cash flow and allows accessible financial reports that help you quickly make informed decisions. Companies can use trucking accounting software to track mileage, generate invoices, do payroll, pay expenses, generate profit reports and so much more. Just like QuickBooks Online, Zoho Books isn’t custom-tailored for trucking businesses. However, it has a powerful mobile accounting app that can help independent truckers in many ways.

TruckingOffice products cover accounting and cash flow, as well as maintain records for IFTA taxes, maintenance expenses and more. The technology is cloud-based and allows you to create as many user accounts as your company needs. Q7 by Frontline Software Technology is the only specialized trucking software on this list that has built-in accounting features—making it our best standalone trucking company accounting software. It allows you to manage bookkeeping tasks, such as paying bills, sending invoices, and reconciling bank accounts.

Whether you’re just starting out, an experienced owner-operator, or anywhere in between, we have a service package that’s just right for you. Schedule a consultation with a member of the Trucker CFO Team and ask us any questions you want.We’re here to help to you with the business of trucking. You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US).

TruckLogics streamlines bookkeeping by limiting manual record entry and delivering one-click financial reports. This includes finding work on load boards, driver and maintenance management, invoicing, and expense tracking. Axon is a trucking management system that handles everything from invoicing to dispatching and tax reporting.

It also earned a perfect mark for tracking features and excelled in ease of use due to its simple user interface that is easy to navigate. Tailwind’s TMS billing and invoicing modules provide greater flexibility than those in other trucking-specific software. For instance, trucking companies have the flexibility to post related bills together with the invoice or post the expenses and bills separately. This allows you to customize your billing workflows based on your specific requirements. While Quickbooks can be used for trucking companies, some trucking-specific features are missing such as cost-per-mile calculations and IFTA reporting.

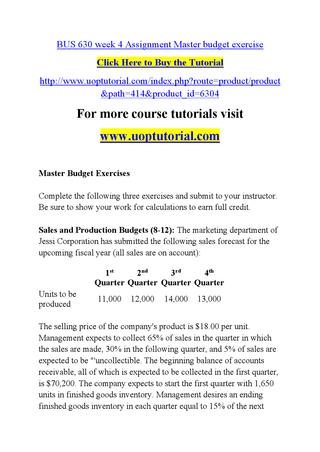

Trucking is a unique industry, so it has some unique taxes it needs to file. For example, trucking companies must pay the Heavy Highway Vehicle Use Tax or Form 2290. You’ll also have to pay income taxes, employment taxes and a fuel tax to the International Fuel Tax Association or IFTA.

- Along with an inventory tracking system, choosing accounting software is one of the most important decisions you can make for your company.

- Variable costs, on the other hand, are expenses that change based on how much the truck is used, such as fuel or maintenance costs.

- The cash basis involves recognizing revenues when you receive payments and deducting expenses when you pay them.

- When it comes to accounting and your taxes, you need to be able to have trust in your provider right off the bat.

- This focus is intended to make it easier to calculate load values and stay on top of receipts for tax filing.

Freight carriers can create customizable reports and dashboards tailored to their specific needs, providing insights into the performance of each entity and the business overall. This feature allows for deep financial analysis and performance monitoring across different https://www.business-accounting.net/ levels of large trucking companies. Tailwind TMS can be pricey for very small trucking company software, but it has a lot to offer mid-size and larger companies. For instance, Tailwind’s Unlimited package enables tracking an unlimited number of shipments per month.

Here’s a rundown of our top picks based on our internal review process and user reviews. One of the main benefits of working with a trucking accountant is that they can help you save time. By taking care of complex financial tasks, you can focus on other areas of your business. This can be especially important for smaller trucking businesses that may not have the resources to hire a full-time accountant. As an example, small business owners can expense only 50% of meal expenses, but truckers can take up to 80% of the actual cost or their per diem allowances. When in doubt, reach out to a professional versed in this type of accounting.

It’s a routine, administrative process that requires relatively little critical thinking. The new strategy could eventually find its way into the commission’s model apportionment … As truckers, we’re looking for something that’s affordable and practical in terms of our accounting services and tax preparation services. Those were the factors that were missing in our previous accounting relationship.

IRS classifies semi-trucks as qualified nonpersonal use vehicles which means companies need to use actual costs rather than employing the standard mileage method. Running a trucking business comes with potential hazards and it is often better to form a different type of entity. A limited liability company (LLC) describe how credit cards affect the following: your personal budget or a corporation are better suited for a transportation business. Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting. Get a step-by-step guide on how to set up an accounting system for your trucking business.

We ranked each truck accounting software based on its affordability, considering the number of users included in each plan and the costs to add an extra seat. We docked a few points for ease of use, as the integrated features may require a steep learning curve for some users. Additionally, we deducted some points for pricing due to the combined cost of the two software programs. While QuickBooks Online handles all your accounting processes, RLS helps you accomplish trucking-related tasks. For instance, you can use RLS to manage your loads, dispatch orders, and track delivery status. You can then transfer the load information to QuickBooks to create invoices, track expenses, and generate reports.